Piercing Line Candlestick Pattern

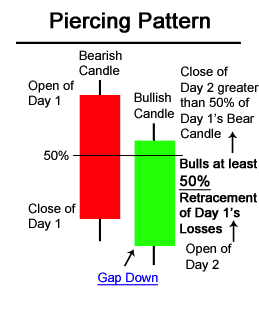

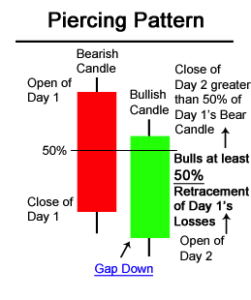

The Piercing Pattern is viewed as a bullish candlestick reversal pattern, similar to the Bullish Engulfing Pattern (see: Bullish Engulfing Pattern). There are two components of a Piercing Pattern formation:

A Parish Candle (Day 1)

Bullish Candle (Day 2)

A Piercing Pattern occurs when a bullish candle on Day 2 closes above the middle of Day 1’s bearish candle.

Moreover, price gaps down on Day 2 only for the gap to be filled (see: Gaps) and closes significantly into the losses made previously in Day 1’s bearish candlestick.

The rejection of the gap down by the bulls typically can be viewed as a bullish sign, and the fact that bulls were able to press further up into the losses of the previous day adds even more bullish sentiment. Bulls were successful in holding prices higher, absorbing excess supply and increasing the level of demand.

Piercing Pattern Candlestick Chart Example

The chart below of Intel (INTC) stock illustrates an example of the Piercing Pattern:

Piercing Pattern Candlestick Potential Buy Signal Generally other technical indicators are used to confirm a buy signal given by the Piercing Pattern (i.e. downward trendline break). Since the Piercing Pattern means that bulls were unable to completely reverse the losses of Day 1, more bullish movement might be expected before an outright potential buy signal is given. Also, more volume than usual on the bullish advance on Day 2 might be a stronger indicator that bulls have taken charge and that the prior downtrend is likely ending.

Bullish Engulfing Pattern (see: Bullish Engulfing Pattern) is typically viewed as being more bullish than the Piercing Pattern because it completely reverses the losses of Day 1 and adds new gains.

For further study, the bearish equivalent of the Piercing Pattern is the Dark Cloud Cover Pattern (see: Dark Cloud Cover).

The information above is for informational and entertainment purposes only and does not constitute trading advice or a solicitation to buy or sell any stock, option, future, commodity, or forex product. Past performance is not necessarily an indication of future performance. Trading is inherently risky. Commodity.com shall not be liable for any special or consequential damages that result from the use of or the inability to use, the materials and information provided by this site.