What Does a Bullish Engulfing Mean?

Simple Explanation:

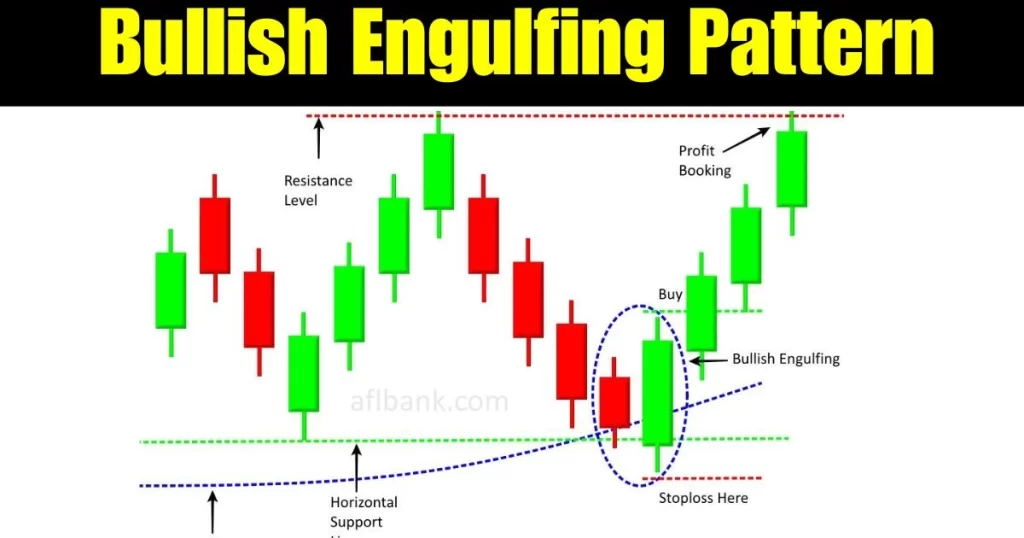

A bullish engulfing pattern is a two-candle pattern in stock charts that signals a possible change from a downtrend to an uptrend. It’s called “engulfing” because the second candle completely covers the first one, showing that buyers have taken over.

- First Candle: A small red candle that shows a decline, indicating the price was falling.

- Second Candle: A large green candle that completely engulfs the red one, showing the price has risen strongly.

Motivational Story:

Imagine a small business struggling for months. Then, a big investor comes in and provides support, turning everything around. This is similar to the bullish engulfing pattern, where the big green candle represents new hope and strength in the market.

Example: The 2008 financial crisis hit many companies hard, but those like Apple rebounded with a bullish engulfing pattern, leading to new growth and success.

Motivational Quote:

“Every setback is a setup for a comeback.” – T.D. Jakes

This quote reflects the essence of the bullish engulfing pattern, where a period of decline sets the stage for a significant rise.

The bullish engulfing pattern is like a turning point. It shows that buyers have stepped in to take control, signaling a potential reversal in trend and offering traders an opportunity to enter the market at the start of an upward movement.

How to Confirm a Bullish Engulfing?

Simple Explanation:

Confirming a bullish engulfing pattern involves looking for additional signs that support the reversal signal. Here’s how to do it:

- Volume: Look for higher trading volume during the engulfing candle, indicating strong buying interest.

- Support Levels: Check if the pattern occurs near a support level, as it strengthens the reversal signal.

- Continuation: Wait for the next day’s price to rise further, confirming the bullish trend.

Motivational Story:

Consider the story of Howard Schultz, who faced rejection multiple times before acquiring Starbucks. His persistence was like confirming a bullish trend—he looked for signs of opportunity and didn’t give up until success was evident.

Example: In March 2020, many stocks showed bullish engulfing patterns with high volume, confirming the market’s recovery after initial pandemic fears.

Motivational Quote:

“Success is not final; failure is not fatal: It is the courage to continue that counts.” – Winston Churchill

This quote emphasizes the importance of perseverance and validation in trading and life.

Confirming a bullish engulfing pattern is like gathering evidence to support a hypothesis. By looking for additional indicators like volume and support levels, traders increase their confidence that the market trend is genuinely changing, leading to more informed and successful trades.

How Reliable is a Bullish Engulfing?

Simple Explanation:

A bullish engulfing pattern is generally considered reliable, but it’s not foolproof. Its reliability depends on factors like market conditions, the strength of the trend, and confirmation signals.

- Higher Reliability: Occurs at strong support levels or after a long downtrend.

- Lower Reliability: In choppy markets or without confirmation signals.

Motivational Story:

Think about J.K. Rowling, who faced numerous rejections before “Harry Potter” was published. Her journey teaches us about persistence and the potential for a breakthrough even when success seems uncertain. The bullish engulfing pattern, like her story, often signals a significant change but requires careful consideration.

Example: Stocks like Tesla often exhibit bullish engulfing patterns followed by significant rallies, illustrating the pattern’s reliability when properly identified.

Motivational Quote:

“The only limit to our realization of tomorrow will be our doubts of today.” – Franklin D. Roosevelt

This quote encourages traders to trust well-formed patterns while remaining cautious.

While the bullish engulfing pattern is a strong indicator of potential reversals, its reliability increases when confirmed with additional signals. Like any investment decision, it requires thoughtful analysis and understanding of market dynamics to make the most informed choices.

What is the Bullish Engulfing Secret?

Simple Explanation:

The “secret” of the bullish engulfing pattern lies in understanding market psychology and using the pattern in conjunction with other indicators. It’s not just about spotting the pattern; it’s about understanding the reasons behind it and confirming its validity.

- Market Psychology: The pattern reflects a change in sentiment from bearish to bullish, indicating strong buying pressure.

- Combining Indicators: Use moving averages, RSI, or MACD to strengthen the signal.

Motivational Story:

The story of Amazon’s rise can be likened to the bullish engulfing secret. Jeff Bezos saw opportunities where others saw challenges, understanding the deeper market trends. This insight, combined with strategic planning, led to Amazon’s success.

Example: Traders using the bullish engulfing pattern with other technical indicators during Apple’s comeback years in 2013 experienced profitable trends.

Motivational Quote:

“Success usually comes to those who are too busy to be looking for it.” – Henry David Thoreau

This quote highlights the importance of understanding underlying trends and taking action when opportunities arise.

The real “secret” of the bullish engulfing pattern is to look beyond the obvious and understand the broader market context. By combining this pattern with other tools and insights, traders can unlock more significant opportunities and make well-informed trading decisions.