Understanding the Exponential Moving Average (EMA)

Understanding the Exponential Moving Average (EMA): Why It Can Give You Quick Results

In the world of trading and technical analysis, the Exponential Moving Average (EMA) is one of the most popular tools used by traders to predict market trends and make informed decisions. The EMA is designed to react more quickly to recent price changes compared to the Simple Moving Average (SMA), making it a valuable indicator for those looking to capture short-term price movements. In this article, we’ll explore what the EMA is, how it works, its advantages and disadvantages, and why it might be the right tool for your trading strategy.

What Is the Exponential Moving Average (EMA)?

The Exponential Moving Average (EMA) is a type of moving average that places more weight and significance on the most recent data points. This weighting allows the EMA to react more quickly to price changes, making it a preferred choice for traders who need timely signals in fast-moving markets.

Key Features of the EMA:

- Greater Emphasis on Recent Prices: Unlike the Simple Moving Average (SMA), which gives equal weight to all data points, the EMA assigns more importance to the latest prices. This makes the EMA more sensitive to recent market trends.

- Quick Response to Market Changes: The EMA’s responsiveness is beneficial for traders looking to identify and capitalize on short-term trends. However, this quick reaction can also lead to more false signals, known as “whipsaws.”

- Smoothing Effect: The EMA smooths out price fluctuations, providing a clearer picture of the underlying trend. This can be particularly helpful in volatile markets where prices fluctuate rapidly.

How Is the EMA Calculated?

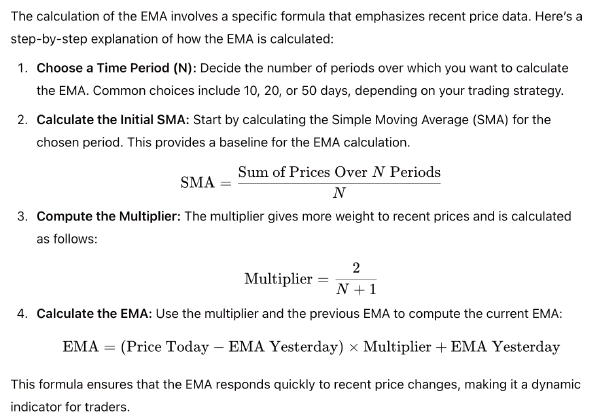

The calculation of the EMA involves a specific formula that emphasizes recent price data. Here’s a step-by-step explanation of how the EMA is calculated:

What Does the Exponential Moving Average Look Like?

When plotted on a chart, the EMA appears as a smooth line that follows the price movements of the asset. Its curvature depends on the chosen time period and the speed at which it reacts to price changes. Let’s look at a practical example to understand how the EMA compares to the Simple Moving Average.

Example: Comparing EMA and SMA

Consider a chart of eBay (EBAY) stock with both a 10-day EMA and a 10-day SMA:

Chart 1 Analysis:

- EMA Reacts Faster: As observed, the EMA line reacts more quickly to changes in price compared to the SMA. This is particularly noticeable during periods of trend reversal, where the EMA adjusts its direction sooner than the SMA.

- Upward Trend Indication: The EMA tends to indicate an upward trend earlier than the SMA, giving traders a head start in recognizing potential buy opportunities.

- Lagging Effect of SMA: The SMA lags behind during price reversals, which can delay the trader’s response to new market conditions.

EMA Compared to Moving Average Crossovers

Moving average crossovers are a common trading strategy that involves using two moving averages to identify buy and sell signals. These crossovers occur when a short-term moving average crosses above or below a long-term moving average.

Example: EMA vs. SMA in Moving Average Crossovers

Here’s a chart showing the Nasdaq 100 exchange-traded fund (QQQQ) with moving average crossovers:

Chart 2 Analysis:

- Crossovers as Signals: In this chart, moving average crossovers are used as buy and sell signals. When the shorter EMA crosses above the longer SMA, it may signal a buying opportunity. Conversely, when the EMA crosses below the SMA, it might indicate a selling opportunity.

- Speed of Reaction: While the EMA reacts more quickly to price movements, it doesn’t always provide faster buy and sell signals compared to SMA when using moving average crossovers.

- MACD Concept: The chart also illustrates the concept behind the popular Moving Average Convergence Divergence (MACD) indicator, which uses EMAs to identify momentum changes and potential trading signals.

Why Use the Exponential Moving Average?

The EMA is favored by many traders for several reasons, each contributing to its effectiveness in different trading scenarios:

1. Timely Entry and Exit Points

- Quick Identification of Trends: The EMA’s sensitivity to recent prices allows traders to spot trends early, providing opportunities to enter or exit trades at optimal points.

- Effective in Volatile Markets: In fast-moving markets, the EMA can help traders stay on top of rapid price changes, ensuring they don’t miss out on profitable trades.

2. Dynamic Adaptation

- Adjustable to Various Timeframes: The EMA can be adapted to suit different trading timeframes, whether you’re a day trader focusing on short-term movements or a swing trader looking at longer trends.

- Responsive to Market Changes: The EMA adapts to new information quickly, allowing traders to adjust their strategies in response to evolving market conditions.

3. Widely Used in Trading Strategies

- Compatibility with Other Indicators: The EMA is often used alongside other technical indicators, such as RSI or MACD, to enhance trading strategies and improve decision-making.

- Integral to Many Systems: Many automated trading systems and algorithms incorporate the EMA due to its effectiveness in identifying trends and reversals.

Pros and Cons of the Exponential Moving Average

While the EMA offers numerous advantages, it’s essential to weigh its pros and cons to determine if it’s the right tool for your trading needs.

Pros:

- Quick Response: The EMA reacts swiftly to price changes, providing timely signals for traders.

- Clearer Trend Indication: By emphasizing recent prices, the EMA offers a clearer picture of current market trends.

- Versatile Application: The EMA can be applied to various markets, including stocks, forex, commodities, and cryptocurrencies.

Cons:

- False Signals (Whipsaws): The EMA’s sensitivity can lead to more false signals, particularly in choppy markets.

- Not Suitable for Long-Term Analysis: The EMA is better suited for short to medium-term analysis, making it less effective for long-term investment strategies.

- Complexity: Calculating the EMA requires more complex formulas than the SMA, which might be a barrier for beginners.

Conclusion

The Exponential Moving Average (EMA) is a powerful tool for traders seeking to gain an edge in fast-paced markets. By prioritizing recent prices, the EMA provides timely insights into market trends, helping traders make informed decisions about when to enter or exit trades. Whether you’re a day trader looking for quick profits or a swing trader aiming to capture short-term trends, the EMA can be a valuable addition to your trading toolkit.

However, it’s crucial to remember that no single indicator can guarantee success. The EMA should be used in conjunction with other analysis techniques and risk management strategies to maximize its effectiveness. By understanding its strengths and limitations, traders can harness the power of the EMA to navigate the complexities of the financial markets and achieve their trading goals.

Where Can I Trade Using EMA?

The EMA is widely used across various trading platforms and markets. Here are some popular places where you can apply EMA in your trading:

- Stock Markets: Platforms like E*TRADE, TD Ameritrade, and Robinhood offer robust tools for applying EMA to stock analysis.

- Forex Markets: Brokers such as Forex.com and OANDA provide forex traders with access to EMA indicators for currency pairs.

- Commodities and Futures: Traders can use EMA on platforms like Interactive Brokers and CME Group to analyze commodities and futures markets.

- Cryptocurrency Exchanges: Exchanges like Binance and Coinbase support EMA indicators for trading digital currencies like Bitcoin and Ethereum.

Further Reading

To deepen your understanding of the Exponential Moving Average and its applications, consider exploring the following resources:

- Books: “Technical Analysis of the Financial Markets” by John J. Murphy provides comprehensive insights into using EMAs and other indicators.

- Online Courses: Websites like Coursera and Udemy offer courses on technical analysis that cover EMAs and their role in trading strategies.

- Trading Forums: Engaging with communities on platforms like Reddit’s r/DayTrading or the TradingView community can provide valuable insights and tips from experienced traders.

By leveraging the EMA and continually learning from various resources, traders can enhance their skills and increase their chances of success in the dynamic world of trading.