Understanding Fibonacci Fans

Fibonacci Fans – How Traders Use Them to Construct Support & Resistance Trendlines

Fibonacci fans are a popular tool in technical analysis used by traders to identify support and resistance levels on price charts. This guide will explain what Fibonacci fans are, how to draw them on a chart, and how traders use them to make informed trading decisions.

What Are Fibonacci Fans?

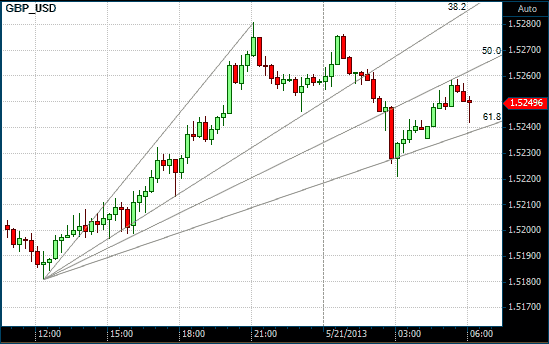

Fibonacci fans are a technical analysis tool that uses Fibonacci ratios to create trendlines on a chart. These trendlines help traders identify potential support and resistance levels, as well as gauge the speed of a trend’s movement.

The basic concept behind Fibonacci fans is similar to other Fibonacci tools: they use ratios derived from the Fibonacci sequence to predict where price movements might find support or face resistance. The Fibonacci sequence includes numbers such as 1, 1, 2, 3, 5, 8, 13, 21, and so on. In trading, key ratios derived from this sequence, like 23.6%, 38.2%, 50%, 61.8%, and 76.4%, are used to construct the fans.

How to Draw Fibonacci Fans

Drawing Fibonacci fans involves the following steps:

- Identify Significant Points: Start by identifying a significant low and high on the chart. For an uptrend, choose the low point as the start and the high point as the end of the trend. For a downtrend, reverse the process.

- Draw the Initial Trendline: Draw a trendline from the significant low to the significant high. This is the base of the Fibonacci fan.

- Apply Fibonacci Ratios: Using charting software, draw lines from the base trendline at the Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, and 76.4%). These lines fan out from the base trendline and extend into the future.

- Analyze the Chart: The resulting fan lines will intersect the price chart, creating levels that traders use to anticipate potential support or resistance areas.

What Does the Fibonacci Fan Show Traders?

Fibonacci fans provide insight into potential areas where the price might change direction based on Fibonacci ratios. Here’s how traders use them:

- Support in Uptrends: In an uptrend, if the price falls below one of the Fibonacci fan trendlines, it is often expected to continue falling until it reaches the next Fibonacci fan line. These trendlines can act as support levels where the price might reverse and move higher again.

- Resistance in Downtrends: In a downtrend, if the price rises to a Fibonacci fan trendline, this line is expected to act as resistance. If the price breaks through this resistance level, the next Fibonacci fan trendline higher may act as the new resistance level.

- Measuring Trend Speed: The distance between Fibonacci fan lines can also give an idea of the trend’s speed. If the price moves quickly between lines, it might indicate a strong trend. If the price moves slowly, the trend might be weakening.

Example Chart Analysis

Let’s look at an example using the S&P 500 exchange-traded fund (SPY) to understand how Fibonacci fans work in practice.

Uptrend Example

- Identify Key Points: Assume SPY has a significant low at $200 and a high at $250.

- Draw the Base Trendline: Draw a trendline from $200 to $250.

- Apply Fibonacci Ratios: Draw the Fibonacci fan lines from this base trendline at the 23.6%, 38.2%, 50%, 61.8%, and 76.4% levels.

- Analyze the Price Movement:

- If the price retraces to the 38.2% Fibonacci fan line and then starts to rise again, this line may be acting as support.

- If the price moves below this line, it might continue to fall until it hits the next Fibonacci fan line.

Downtrend Example

- Identify Key Points: Suppose SPY had a high of $250 and a low of $200.

- Draw the Base Trendline: Draw a trendline from $250 to $200.

- Apply Fibonacci Ratios: Draw the Fibonacci fan lines from this base trendline at the 23.6%, 38.2%, 50%, 61.8%, and 76.4% levels.

- Analyze the Price Movement:

- If the price rises and hits the 38.2% Fibonacci fan line, it might face resistance at this level.

- If the price breaks through this resistance, the next Fibonacci fan line higher could act as the new resistance level.

What If The Price Moves Below or Above the Trendline?

Understanding what happens when the price moves relative to the Fibonacci fan lines is crucial:

- Price Moves Below the Trendline: When the price moves below a Fibonacci fan trendline in an uptrend, it often indicates that the price might continue to decline until it reaches the next fan line. This lower trendline can act as a new support level where the price might find buying interest.

- Price Moves Above the Trendline: In a downtrend, if the price moves above a Fibonacci fan trendline, it might indicate a potential reversal or weakening of the downtrend. The price could face resistance at the next higher Fibonacci fan line.

Where Can I Start Trading and Use Fibonacci Fans?

If you want to start using Fibonacci fans in your trading strategy, follow these steps:

- Choose a Trading Platform: Select a trading platform that offers Fibonacci tools. Many platforms like TradingView, MetaTrader, and Thinkorswim provide Fibonacci fans.

- Practice Drawing Fans: Use historical price charts to practice drawing Fibonacci fans and interpreting the results. This helps you understand how the fan lines interact with price movements.

- Apply to Real-Time Trading: Once comfortable, apply Fibonacci fans to real-time charts. Monitor how the price reacts to the fan lines and use this information to guide your trading decisions.

- Combine with Other Tools: Use Fibonacci fans alongside other technical indicators, such as moving averages, trend lines, or candlestick patterns, for a more comprehensive analysis.

Conclusion

Fibonacci fans are a valuable tool in technical analysis, helping traders identify potential support and resistance levels based on Fibonacci ratios. By drawing fan lines on a price chart, traders can gain insights into where the price might reverse or find support.

However, as with any trading tool, Fibonacci fans should not be used in isolation. Combining them with other technical indicators and market analysis techniques can provide a more complete picture and improve trading decisions. With practice and experience, Fibonacci fans can become an effective part of your trading strategy.