Understanding Fibonacci Retracement

Analysis of Fibonacci Retracement: Uses & What It Tells Traders

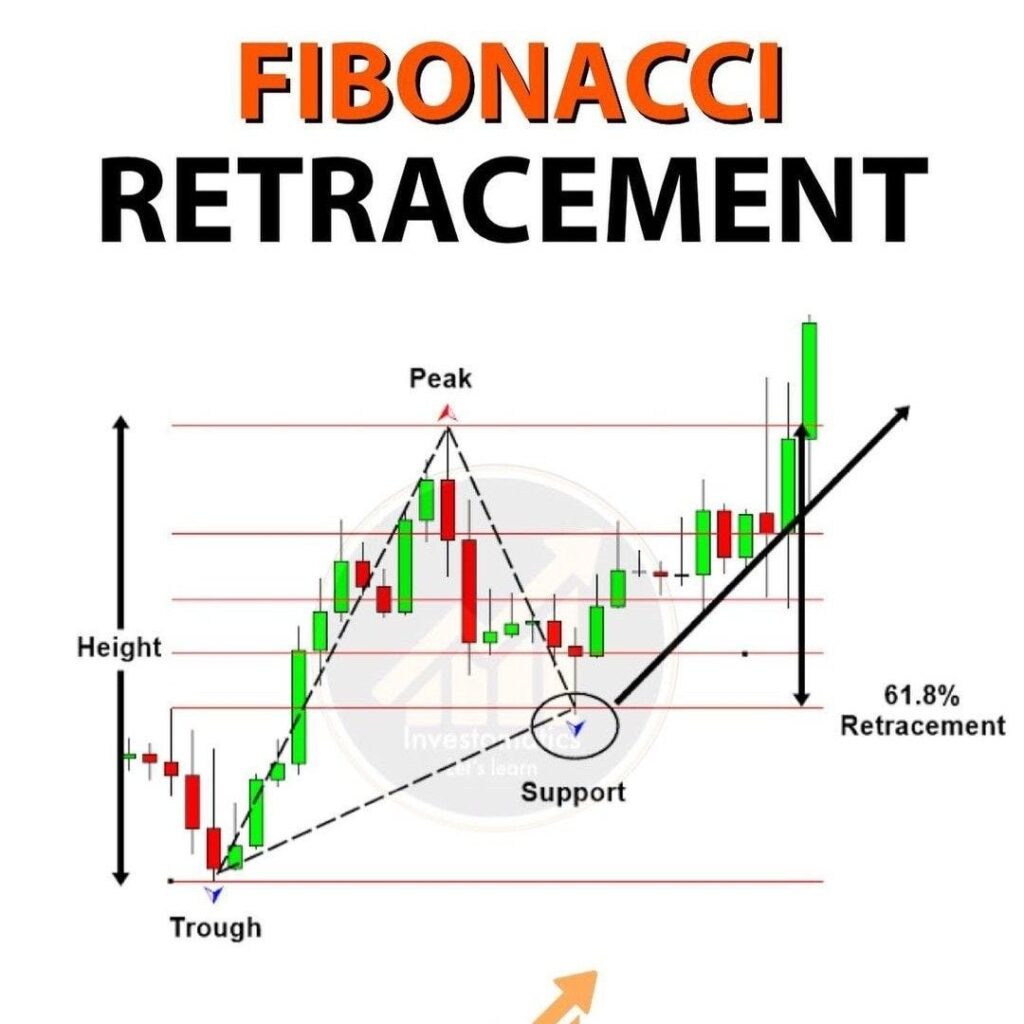

Fibonacci retracement is a popular tool in technical analysis used by traders to identify potential points of support and resistance on price charts. This guide will explain what Fibonacci retracement is, how to calculate it, and why it continues to be a valuable tool for traders. We will also discuss the differences between Fibonacci retracement and other Fibonacci tools.

What Is Fibonacci Retracement?

Fibonacci retracement is a technical analysis tool based on the Fibonacci sequence, a series of numbers that naturally occur in various aspects of nature. The sequence starts with 1, 1, and then each subsequent number is the sum of the previous two (e.g., 1, 2, 3, 5, 8, 13, 21, etc.). In trading, Fibonacci ratios derived from this sequence are used to identify potential levels where prices might experience support or resistance.

Key Fibonacci Ratios

The most commonly used Fibonacci ratios in retracement analysis are:

- 23.6%

- 38.2%

- 50%

- 61.8%

- 76.4%

The 61.8% ratio is particularly significant and is often referred to as the “Golden Ratio.” It is found by dividing one Fibonacci number by the next number in the sequence (e.g., 55 divided by 89 equals approximately 0.618).

How To Calculate Fibonacci Retracement Levels

Calculating Fibonacci retracement levels involves a few straightforward steps. Here’s a simple guide:

- Identify Key Points: First, find the most significant low and high points on the price chart. This is typically the start and end of a major price move or trend.

- Measure the Price Range: Determine the distance between the significant high and low. This distance is the full range of the trend you are analyzing.

- Apply Fibonacci Ratios: Use the Fibonacci ratios to calculate retracement levels. These levels are derived by multiplying the full range by the Fibonacci ratios (e.g., 23.6%, 38.2%, 50%, 61.8%, 76.4%).

- Plot the Levels: Plot these calculated levels on the chart. These levels will act as potential support or resistance areas where the price might reverse or stall.

Example Calculation

Let’s say a stock moved from a low of $50 to a high of $100. To calculate the Fibonacci retracement levels:

- Full Range: $100 – $50 = $50

- 23.6% Level: $50 x 0.236 = $11.80, so the retracement level is $100 – $11.80 = $88.20

- 38.2% Level: $50 x 0.382 = $19.10, so the retracement level is $100 – $19.10 = $80.90

- 50% Level: $50 x 0.50 = $25.00, so the retracement level is $100 – $25.00 = $75.00

- 61.8% Level: $50 x 0.618 = $30.90, so the retracement level is $100 – $30.90 = $69.10

Demonstration of Retracement Levels

Let’s take a look at how Fibonacci retracement levels are applied on a chart. We will use the S&P 500 Depository Receipts (SPY) for our example. The process is the same for individual stocks, commodities, or currency pairs.

Example 1: Uptrend

- Identify the Trend: Suppose SPY had a significant low at $200 and a high at $250.

- Calculate Levels: Apply the Fibonacci ratios to the price range ($250 – $200 = $50):

- 23.6% retracement: $250 – ($50 x 0.236) = $250 – $11.80 = $238.20

- 38.2% retracement: $250 – ($50 x 0.382) = $250 – $19.10 = $230.90

- 50% retracement: $250 – ($50 x 0.50) = $250 – $25.00 = $225.00

- 61.8% retracement: $250 – ($50 x 0.618) = $250 – $30.90 = $219.10

- Analyze the Chart: Plot these levels on the chart. Traders might look for price action around these levels to gauge potential support or resistance.For instance, if the price retraces to the 38.2% level and holds, this level might be seen as a strong support.

Example 2: Downtrend

- Identify the Trend: Suppose SPY had a high at $250 and a low at $200.

- Calculate Levels: The retracement levels are calculated in the same way, but the levels are plotted above the low point.

- 23.6% retracement: $200 + ($50 x 0.236) = $200 + $11.80 = $211.80

- 38.2% retracement: $200 + ($50 x 0.382) = $200 + $19.10 = $219.10

- 50% retracement: $200 + ($50 x 0.50) = $200 + $25.00 = $225.00

- 61.8% retracement: $200 + ($50 x 0.618) = $200 + $30.90 = $230.90

- Analyze the Chart: Observe how the price reacts as it approaches these retracement levels. If the price struggles to move past these levels, it might indicate strong resistance.

How Are Retracement Levels Used?

Traders use Fibonacci retracement levels to make informed decisions about buying and selling. Here’s how they can be applied:

- Identifying Support and Resistance: When the price retraces from a recent high, traders look at Fibonacci levels to identify where the price might find support. Conversely, during an uptrend, these levels can act as resistance points.

- Setting Targets and Stop-Losses: Traders can set profit-taking targets near Fibonacci retracement levels. Similarly, stop-loss orders can be placed just below key support levels or above key resistance levels to manage risk.

- Confirmation with Other Indicators: Fibonacci retracement levels are often used in conjunction with other technical indicators, such as moving averages or trend lines, to confirm potential entry and exit points.

Difference Between Fibonacci Retracements and Extensions

While Fibonacci retracements focus on potential support and resistance levels within a current trend, Fibonacci extensions are used to forecast potential price targets beyond the current trend. Extensions help identify possible future highs or lows, providing additional insight for long-term trading strategies.

Where Can I Start Trading and Use Fibonacci Retracement?

If you’re new to Fibonacci retracement, here’s how to get started:

- Choose a Trading Platform: Select a trading platform that offers Fibonacci tools. Popular platforms like TradingView, MetaTrader, and Thinkorswim provide easy access to Fibonacci retracement tools.

- Learn and Practice: Start by practicing Fibonacci retracement on historical charts to understand how the levels work. Use demo accounts to refine your skills without risking real money.

- Apply in Real-Time: Once comfortable, apply Fibonacci retracement to real-time charts. Monitor how the price interacts with these levels and use this information to make trading decisions.

- Combine with Other Tools: Enhance your analysis by combining Fibonacci retracement with other technical indicators, such as trend lines, candlestick patterns, or momentum indicators.

Conclusion

Fibonacci retracement remains a popular tool among traders due to its ability to identify potential levels of support and resistance based on naturally occurring ratios. By calculating and plotting these retracement levels, traders can gain valuable insights into where price movements might reverse or stall.

However, it’s important to remember that Fibonacci retracement is just one tool in a trader’s toolkit. For best results, it should be used in conjunction with other technical indicators and market analysis techniques. With practice and experience, Fibonacci retracement can become a powerful part of your trading strategy.