How to Trade the Bearish Engulfing Pattern

How to Trade the Bearish Engulfing Pattern: A Comprehensive Guide for Beginners

Introduction

If you’re new to investing and want to learn a powerful candlestick pattern that can help you identify potential reversals in the market, the bearish engulfing pattern is a great place to start. This pattern is easy to recognize and can provide valuable insights into when a bullish trend might be coming to an end. In this comprehensive guide, we’ll break down the bearish engulfing pattern, explain how to spot it on price charts, and share simple strategies for trading it effectively.

1. Understanding the Bearish Engulfing Pattern

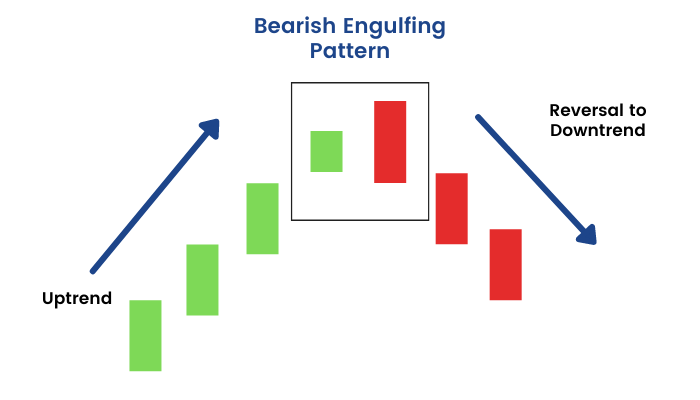

The bearish engulfing pattern is a candlestick pattern that signals a shift in market sentiment from bullish (upward) to bearish (downward). It consists of two candles, with the second one “engulfing” the first one. The first candle is a small bullish candle, and the second one is a larger bearish candle that completely covers or “engulfs” the first candle.

2. Recognizing the Bearish Engulfing Pattern

To trade the bearish engulfing pattern, you need to be able to spot it on price charts. Here’s how to recognize it:

Look for two adjacent candles on the chart.

The first candle should be a small green (bullish) candle, and the second one should be a larger red (bearish) candle.

The red candle should completely cover the green candle, including the high and low price points.

3. Trading Strategies with the Bearish Engulfing Pattern

Once you’ve identified the bearish engulfing pattern, it’s essential to understand how to use it in your trading strategies.

3.1 Bearish Engulfing as a Reversal Signal

The bearish engulfing pattern is a powerful reversal signal. When you see this pattern after a prolonged bullish trend, it suggests that the market sentiment is changing, and the price might start moving downward.

3.2 Entry and Exit Strategies

When trading the bearish engulfing pattern, you should consider the following entry and exit strategies:

Entry: Enter a short trade (betting the price will go down) when you spot the bearish engulfing pattern.

Stop-Loss: Set a stop-loss order just above the high of the bearish engulfing candle to limit potential losses if the market reverses.

Take Profit: Determine a profit target based on your risk-reward ratio, and exit the trade when the price reaches that level.

3.3 Trading Scenarios and Risk-Reward Ratio

Always assess the trading scenario before executing a trade. Consider factors like overall market trends, support and resistance levels, and other technical indicators to strengthen your bearish engulfing signal. Maintain a favorable risk-reward ratio by aiming for higher potential profits than potential losses.

4. Bearish Engulfing with Other Candlestick Patterns

To increase the reliability of your trading decisions, you can combine the bearish engulfing pattern with other technical analysis tools:

Support and Resistance: Look for the bearish engulfing pattern near key support and resistance levels for confirmation.

Moving Averages: Use moving averages to confirm the bearish engulfing signal and identify potential trend changes.

5. Risk Management and Trade Psychology

As a beginner investor, it’s crucial to manage your risks properly:

Position Size: Only risk a small portion of your total capital on each trade, typically 1% to 2%.

Leverage and Margin: Avoid excessive leverage and understand the risks associated with trading on margin.

Emotional Discipline: Stay calm and patient, and stick to your trading plan. Avoid making impulsive decisions based on emotions.

6. Backtesting and Practice

Before trading the bearish engulfing pattern with real money, practice on a demo account and backtest historical data to gain confidence in your strategies.

Conclusion

Trading the bearish engulfing pattern can be a valuable addition to your investing toolkit. Remember to start small, practice, and be disciplined in managing your risks. As you gain experience and knowledge, you’ll be better equipped to use this powerful candlestick pattern to enhance your trading decisions and increase your chances of success in the exciting world of investing.