Peer-to-peer lending

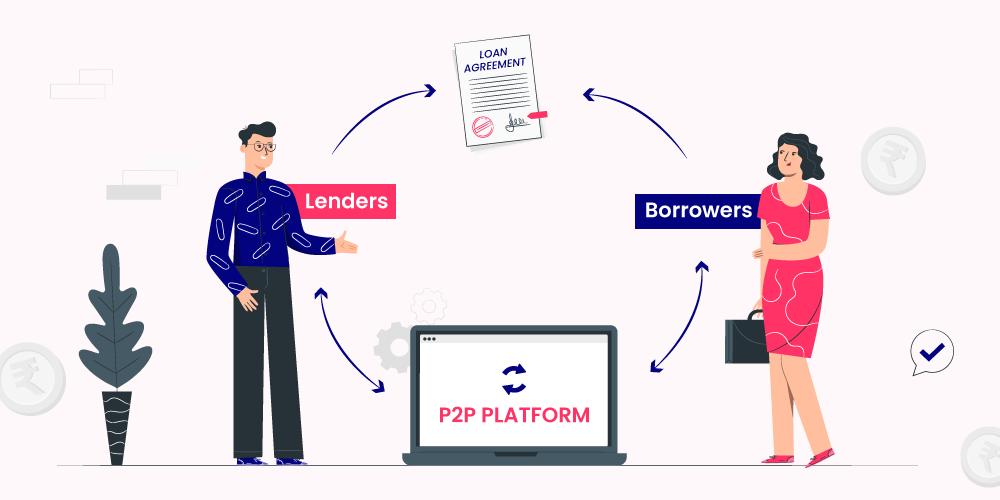

Peer-to-peer lending (P2P lending) is a type of lending where individuals lend money to other individuals or businesses directly, without the involvement of a bank or other financial institution. P2P lending platforms typically match borrowers with lenders who are interested in providing loans.

There are two main types of P2P lending:

- Consumer lending: This type of P2P lending allows individuals to lend money to other individuals for personal purposes, such as debt consolidation, home improvement, or medical expenses.

- Business lending: This type of P2P lending allows individuals to lend money to businesses for working capital, equipment purchases, or other business expenses.

P2P lending offers a number of benefits for both borrowers and lenders. For borrowers, P2P lending can provide access to loans with lower interest rates and more flexible terms than traditional bank loans. For lenders, P2P lending can offer a higher return on investment than traditional savings accounts or bonds.

However, there are also some risks associated with P2P lending. For borrowers, the risk is that they may not be able to repay the loan, which could result in a default on the loan and damage their credit score. For lenders, the risk is that the borrower may not be able to repay the loan, which could result in a loss of investment.

Overall, P2P lending is a relatively new and evolving form of lending. It offers a number of benefits for both borrowers and lenders, but there are also some risks involved. If you are considering using P2P lending, it is important to do your research and understand the risks involved.

Here are some of the pros and cons of P2P lending:

Pros:

- Lower interest rates: P2P loans can offer lower interest rates than traditional bank loans.

- More flexible terms: P2P loans can offer more flexible terms than traditional bank loans, such as shorter repayment periods or lower monthly payments.

- Easy to qualify: P2P loans can be easier to qualify for than traditional bank loans, especially for borrowers with bad credit.

- Peer-to-peer lending can be a great way to build your credit history.

Cons:

- Risk of default: There is always the risk that the borrower may not be able to repay the loan.

- Hidden fees: P2P lenders may charge hidden fees, such as origination fees or late payment fees.

- Lack of regulation: P2P lending is not as regulated as traditional banking, which can leave borrowers and lenders vulnerable.

Overall, P2P lending can be a great option for borrowers who are looking for lower interest rates and more flexible terms. However, it is important to do your research and understand the risks involved before using P2P lending.