Understanding Simple Moving Averages: A Beginner’s Guide

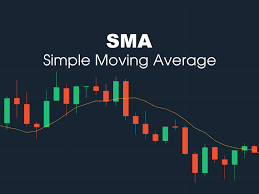

In the world of trading and investing, there are many tools that help traders and investors make decisions about buying and selling assets like stocks, commodities, and currencies. One of the most popular and commonly used tools is the Simple Moving Average (SMA). This guide will break down what a Simple Moving Average is, how it works, and how you can use it to improve your trading strategies.

What is a Simple Moving Average (SMA)?

The Simple Moving Average (SMA) is a basic type of moving average used in technical analysis. In simple terms, it’s a tool that smooths out price data to help identify trends over a specific period. It does this by calculating the average price of an asset over a set number of periods (like days, weeks, or months).

For example, if you are looking at a 10-day SMA for a stock, you would add up the closing prices of that stock for the last 10 days and then divide that total by 10. This gives you the average price of the stock over the past 10 days. The SMA is updated each day, as the oldest day’s price is dropped and the most recent day’s price is added.

Why is the Simple Moving Average Important?

The SMA is important because it helps traders and investors see trends more clearly. Instead of looking at a stock’s price that jumps up and down, the SMA smooths out these fluctuations to show a clearer picture of the overall trend. This makes it easier to see whether the price is generally going up or down.

Here’s why the SMA is useful:

- Trend Identification: It helps identify whether the price of an asset is in an uptrend, downtrend, or moving sideways.

- Smoothing Out Price Fluctuations: By averaging the prices over time, the SMA reduces the noise from short-term price fluctuations and highlights the overall direction of the trend.

- Making Decisions: Traders often use the SMA to make buying or selling decisions based on the direction of the trend.

How to Calculate the Simple Moving Average

To calculate the SMA, follow these simple steps:

- Choose Your Time Period: Decide on the number of days or periods you want to use. Common time periods are 10 days, 50 days, or 200 days.

- Add Up the Prices: Add together the closing prices of the asset for the chosen number of days.

- Divide by the Number of Days: Divide the total by the number of days to get the average.

For example, if you are calculating a 5-day SMA and the closing prices for the last 5 days were $10, $12, $11, $13, and $14, you would:

- Add the prices: $10 + $12 + $11 + $13 + $14 = $60

- Divide by 5: $60 / 5 = $12

So, the 5-day SMA would be $12.

Using the SMA to Identify Trends

The SMA is used to identify trends in several ways:

- Crossovers: One common method is to look for crossovers. For instance, if the price of an asset crosses above the SMA, it might be a signal that the price is starting an uptrend. Conversely, if the price crosses below the SMA, it might be a sign of a downtrend.

- Trend Confirmation: When the price is consistently above the SMA, it usually indicates an uptrend. If the price is consistently below the SMA, it indicates a downtrend.

- Support and Resistance Levels: The SMA can also act as a support or resistance level. For example, during an uptrend, the SMA might act as a support level where the price bounces off. During a downtrend, it might act as a resistance level where the price struggles to rise above.

Example of SMA in Action

Let’s look at a practical example of how the SMA works. Suppose you are analyzing a stock that has been trading with the following closing prices for the last 10 days: $20, $22, $21, $23, $24, $25, $26, $27, $28, and $29.

To calculate the 10-day SMA:

- Add up the prices: $20 + $22 + $21 + $23 + $24 + $25 + $26 + $27 + $28 + $29 = $245

- Divide by 10: $245 / 10 = $24.50

The 10-day SMA is $24.50. If the current price of the stock is $26, it is above the SMA, suggesting that the stock is in an uptrend. If the price were below the SMA, it might suggest a downtrend.

SMA vs. Other Moving Averages

There are other types of moving averages besides the SMA, such as the Exponential Moving Average (EMA). The key difference is that the EMA gives more weight to recent prices, making it more responsive to recent price changes than the SMA. The SMA gives equal weight to all prices in the time period, which can make it slower to react to recent price changes.

Traders often use the SMA in conjunction with other indicators to get a fuller picture of the market. For example, they might compare the SMA with the EMA to see how quickly the price is changing relative to the average.

How to Use the SMA in Your Trading Strategy

To use the SMA effectively, consider the following tips:

- Combine with Other Indicators: Use the SMA with other indicators to confirm trends and signals. For instance, combining the SMA with the Relative Strength Index (RSI) can help validate buy or sell signals.

- Choose the Right Time Period: Select a time period for the SMA that matches your trading strategy. Shorter time periods (like 10 or 20 days) are more responsive to price changes, while longer time periods (like 50 or 200 days) show longer-term trends.

- Watch for Crossovers: Look for crossovers where the price crosses the SMA to identify potential buy or sell opportunities.

- Monitor for Trend Changes: Use the SMA to spot potential changes in the trend. If the price crosses the SMA and stays above or below it, this can signal a new trend.

Common Mistakes to Avoid

- Relying on SMA Alone: The SMA is a helpful tool, but it should not be the only indicator you use. Always combine it with other tools and analysis methods.

- Ignoring Market Conditions: Be aware of overall market conditions. The SMA might show a trend, but market news or events can impact the price and make the trend less reliable.

- Choosing the Wrong Time Period: Selecting the wrong time period for the SMA can lead to misleading signals. Make sure the time period you choose aligns with your trading goals and strategy.

Conclusion

The Simple Moving Average (SMA) is a fundamental and widely used tool in technical analysis. It helps traders and investors identify trends, smooth out price data, and make informed decisions. By understanding how to calculate and use the SMA, you can improve your ability to analyze market movements and develop effective trading strategies.

Whether you’re new to trading or looking to refine your approach, the SMA is a versatile tool that can provide valuable insights into price trends and potential trading opportunities. For more details on other types of moving averages or advanced trading strategies, you can explore further resources and guides.

For additional reading and information, you can visit pngeans.com SMA guide.

This guide covers the basics of the SMA, but remember that successful trading involves understanding and using a combination of tools and strategies to navigate the complexities of the market.

4o mini