Tweezer Top & Bottom Candlestick Pattern

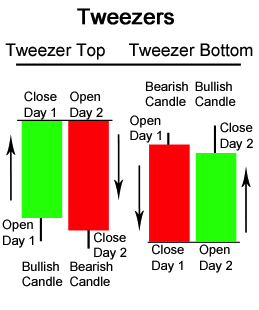

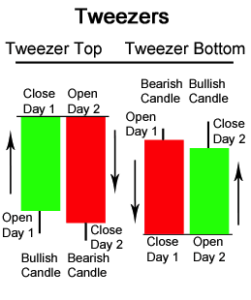

The Tweezer Top formation is viewed as a bearish reversal pattern seen at the top of uptrends and the Tweezer Bottom formation is viewed as a bullish reversal pattern seen at the bottom of downtrends.

Tweezer Top formation consists of two candlesticks: Bullish Candle (Day 1) Bearish Candle (Day 2) Tweezer Bottom formation consists of two candlesticks: Bearish Candle (Day 1) Bullish Candle (Day 2) Sometimes Tweezer Tops or Bottoms have three candlesticks.

A bearish Tweezer Top occurs during an uptrend when bulls take prices higher, often closing the day off near the highs (typically a strong bullish sign). However, on the second day, how traders feel (i.e. their sentiment) reverses completely. The market opens and goes straight down, often eliminating the entire gains of Day 1.

The reverse, a bullish Tweezer Bottom occurs during a downtrend when bears continue to take prices lower, usually closing the day near the lows (typically a strong bearish sign). Nevertheless, Day 2 is completely opposite because prices open and go nowhere but upwards. This bullish advance on Day 2 sometimes eliminates all losses from the previous day.

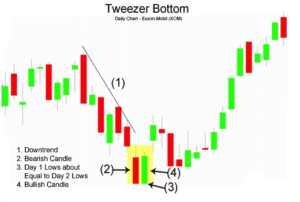

Tweezer Bottom Candlestick Chart Example

A Tweezer Bottom is shown below in the chart of Exxon-Mobil (XOM) stock:

The bears pushed the price of Exxon-Mobil (XOM) downwards on Day 1; however, the market on Day 2 opened where prices closed on Day 1 and went straight up, reversing the losses of Day 2. A potential buy signal might be given on the day after the Tweezer Bottom, if there were other confirming signals.

Intra-day Tweezer Tops and Bottoms

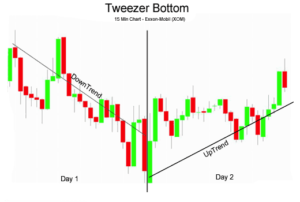

The bullish Tweezer Bottom formation shown on the last page of the daily chart of Exxon-Mobil is shown below with a 15-minute chart spanning the two days the Tweezer Bottom pattern was emerging:

Notice how Exxon-Mobil (XOM) stock went downwards the whole day on Day 1. Then on Day 2, the bearish sentiment of Day 1 was completely reversed and XOM stock went up the whole day. This sudden and drastic change of opinion between Day 1 and Day 2 could be viewed as an overnight transfer of power from bears to bulls.

The 15-minute chart below of the E-mini Russell 2000 Futures contract shows how a three day Tweezer Top usually develops:

On Day 1, the bulls were in charge of the Russell 2000 E-mini. On Day 2, however, the bulls began the day trying to make a new high, but were rejected by the overhead resistance created by the prior day’s highs. The market then sank quickly only to recover halfway by the end of the close on Day 2. Day 3 opened with a spectacular gap up, but the bulls were promptly rejected by the bears at the now established resistance line. The Russell 2000 E-mini then fell for the rest of the day. Many classic chartists will recognize this triple Tweezer Top as a Double Top formation (see: Double Top).

The Tweezer Top and Bottom reversal pattern can visually indicate a transfer of power and sentiment from the bulls and the bears. Of course other technical indicators should be consulted before making a buy or sell signal based on the Tweezer patterns.

The information above is for informational and entertainment purposes only and does not constitute trading advice or a solicitation to buy or sell any stock, option, future, commodity, or forex product. Past performance is not necessarily an indication of future performance. Trading is inherently risky. Commodity.com shall not be liable for any special or consequential damages that result from the use of or the inability to use, the materials and information provided by this site.