Understanding Volatility in Trading

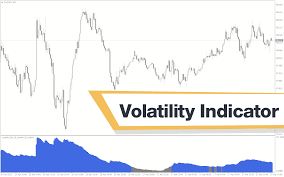

This guide will help you understand what the volatility indicator is and how you can use it to spot when markets might change direction or recognize trends. We’ll also look at some charts to see how it works.

What Is Volatility?

Volatility is all about how much prices move up and down. The volatility indicator measures how wild these movements are and helps us understand market behavior.

Here are some key points about volatility:

- Strong Upward Trends: When prices are going up strongly, the volatility is usually low. This means prices are not jumping around too much.

- Strong Downward Trends: When prices are dropping strongly, the volatility is usually high. This means prices are moving a lot.

- Trend Reversals: If the volatility increases suddenly, it might mean that the trend is about to reverse or change direction.

How Strong Trends Affect Volatility

Let’s look at an example:

In the chart of 5,000-ounce silver futures, you can see that when the price of silver was rising steadily, the volatility was actually going down. This means that even though the price was going up, it wasn’t jumping around a lot. When the trend changed direction, volatility started increasing again.

Note: This is just an example to show how it works and is not advice to trade.

Increased Volatility and Price Bottoms

When prices hit their lowest point (or bottom), volatility usually increases.

- If you notice an increase in volatility after prices have been going down, it might mean that the prices are bottoming out, or reaching their lowest point.

- During these times, traders might decide to exit or reduce their short positions (selling investments they borrowed), as increased volatility at a bottom may signal a potential trend change.

- To decide when to buy or enter a long position (betting the price will go up), traders will use other indicators alongside volatility.

For example, in the S&P 500 E-mini futures contract chart, you can see how increased volatility marks the bottom.

FAQ: How Is Volatility Calculated?

- Volatility is calculated by comparing current or expected returns against the average return of a stock or market.

- It measures how much prices have changed, whether up or down.

- Volatility can be reported daily, weekly, monthly, or yearly.

- It is calculated using two main methods: variance and standard deviation. Standard deviation is simply the square root of variance, and both help in understanding how spread out the price movements are from the average.