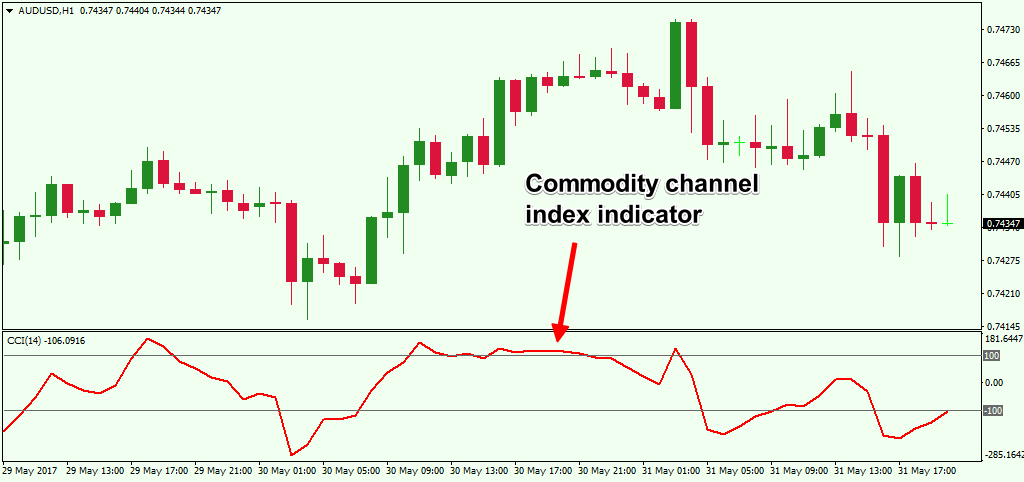

Commodity Channel Index

Commodity Channel Index (CCI): Your Key to Smart Trading

Introduction (approx. 100 words): Welcome to the exciting world of trading, where fortunes can be made with the right strategies! Among the myriad of technical indicators, the Commodity Channel Index (CCI) stands out as a powerful tool for identifying trends and potential buy/sell opportunities. In this comprehensive guide, we’ll explore the ins and outs of CCI, its pros and cons, and most importantly, how you can use it to make more informed and lucrative trading decisions.

- Understanding the Commodity Channel Index : The Commodity Channel Index, developed by Donald Lambert in 1980, is a versatile momentum-based oscillator that helps traders identify potential price reversals and overbought/oversold conditions in the market. CCI measures the current price level relative to its average over a specific period, indicating whether an asset is in a state of overextension or undervaluation. This unique feature enables traders to spot early trends and potential entry and exit points, making it a valuable addition to any trader’s toolkit.

- Pros of Using Commodity Channel Index . Early Trend Identification: CCI excels at identifying emerging trends and price reversals, allowing traders to position themselves ahead of the crowd and maximize profits. b) Overbought/Oversold Conditions: By indicating overbought or oversold levels, CCI helps traders identify potential turning points in the market, leading to well-timed trades. c) Versatility: CCI works across various financial instruments and timeframes, making it suitable for traders with different preferences and strategies. d) Objective Trading: CCI provides clear signals and removes emotional bias, allowing traders to stick to their strategies and avoid impulsive decisions. e) Effective Stop-Loss Placement: CCI’s ability to identify potential price reversals aids traders in setting more effective stop-loss levels, minimizing potential losses.

- Cons of Using Commodity Channel Index. Whipsaw Signals: In choppy or sideways markets, CCI can generate false signals, leading to potential losses if traders rely solely on its indications. b) Lagging Indicator: As a momentum oscillator, CCI may lag behind the actual price movements, potentially causing traders to miss some early entry opportunities. c) Sensitivity to Extreme Price Swings: In highly volatile markets, CCI might produce unreliable readings due to extreme price fluctuations. d) Not a Standalone Solution: CCI works best when combined with other technical indicators or fundamental analysis to validate trading signals. e) Requires Skill and Practice: Interpreting CCI signals requires experience and understanding of market conditions, which might be challenging for inexperienced traders.

- When to Buy and Sell Using Commodity Channel Index. Buy Signal: Look for the CCI line crossing above the -100 level from below, indicating an upward trend and a potential buy opportunity. Confirm with other technical indicators and price patterns before executing the trade.

b) Sell Signal: Observe the CCI line crossing below the 100 level from above, signaling a downward trend and a potential sell opportunity. As with buy signals, validate with other indicators and market context before making a trade.

Conclusion The Commodity Channel Index is a powerful tool for traders seeking to enhance their decision-making process and maximize trading profits. Despite its drawbacks, CCI’s ability to identify trends and overbought/oversold conditions makes it a valuable addition to any trader’s arsenal. Remember, CCI works best in conjunction with other technical tools and sound trading strategies. With diligent practice and continuous learning, you can harness the potential of CCI to navigate the dynamic world of trading with greater confidence and success. Happy trading!