MACD

What is MACD?

MACD stands for Moving Average Convergence Divergence. It is a popular technical indicator used in financial markets, especially in trading stocks, forex, and cryptocurrencies. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. The result is plotted on a separate chart, known as the MACD line.

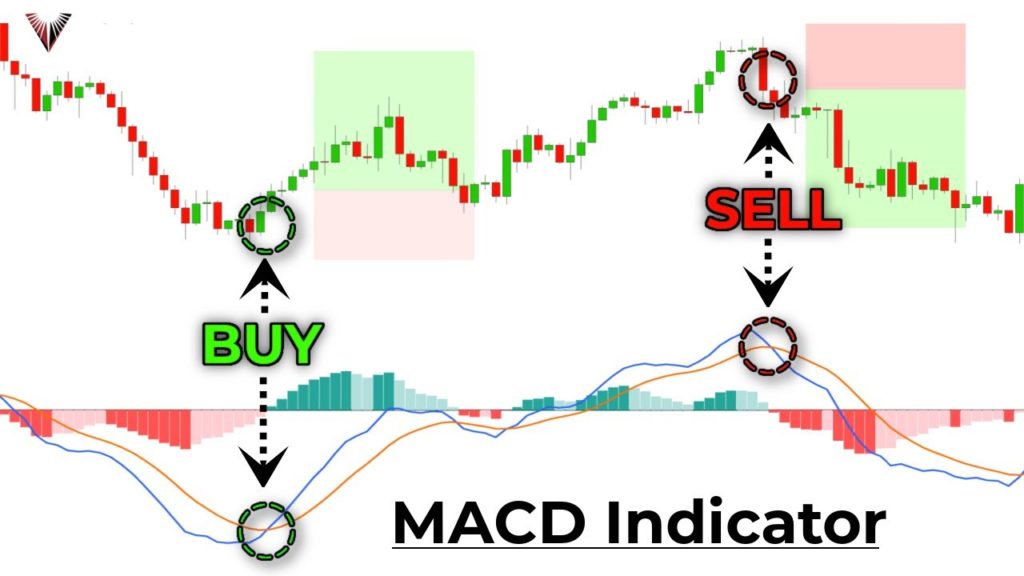

Additionally, a 9-period EMA, called the signal line, is calculated from the MACD line to provide buy and sell signals. Traders use the MACD to identify trends, momentum, and potential entry and exit points in the market. When the MACD line crosses above the signal line, it generates a bullish signal, suggesting a potential uptrend. Conversely, when the MACD line crosses below the signal line, it generates a bearish signal, indicating a potential downtrend.

How to Buy and Sell Using MACD?

Buying and selling using the MACD involves looking for specific signals and crossovers on the MACD chart. Here’s a step-by-step guide on how to use the MACD for trading:

- Identify the MACD Line and Signal Line: On your trading platform, add the MACD indicator. The MACD line is usually displayed as a solid line, while the signal line is shown as a dotted line.

- Bullish Signal – Buy: Look for a bullish crossover, which occurs when the MACD line crosses above the signal line. This indicates a potential uptrend and is a signal to consider buying the asset.

- Bearish Signal – Sell: Look for a bearish crossover, which happens when the MACD line crosses below the signal line. This indicates a potential downtrend and is a signal to consider selling or shorting the asset.

- Divergence: Pay attention to divergence between the MACD and the price chart. If the price is making higher highs, but the MACD is making lower highs (or vice versa), it could signal a potential trend reversal.

- Confirmation: Use other technical indicators or chart patterns to confirm the MACD signals before making a trade. It’s essential to have multiple indicators aligning to increase the accuracy of your trading decisions.

- Risk Management: Always implement proper risk management techniques, such as setting stop-loss orders to limit potential losses if the trade goes against you.

Remember, the MACD is just one tool in a trader’s toolbox. It’s essential to use it in conjunction with other technical indicators, price analysis, and market sentiment to make well-informed trading decisions. Additionally, practice and test your strategies in a demo or paper trading environment before applying them to real trades.

Pros of MACD:

- Trend Identification: MACD helps traders identify trends and potential trend reversals, making it valuable for trend-following strategies.

- Clear Signals: The crossovers between the MACD line and signal line provide clear buy and sell signals, making it easy for traders to interpret.

- Divergence Detection: MACD can identify divergences between price and momentum, which can be a precursor to trend reversals.

- Versatility: MACD can be used on various timeframes and for different assets, including stocks, forex, cryptocurrencies, and commodities.

- Popular Indicator: It is widely used by traders, which can increase its effectiveness due to its popularity.

Cons of MACD:

- Lagging Indicator: Like many other technical indicators, MACD relies on historical data, which means it may lag behind the most current price movements.

- False Signals: MACD can produce false signals, especially in choppy or sideways markets, leading to potential trading losses.

- Subjective Interpretation: Interpretation of crossovers and divergences may vary among traders, leading to subjective decision-making.

- Overbought/Oversold Conditions: MACD doesn’t have specific overbought or oversold levels, making it less effective in identifying extreme market conditions.

- Not Standalone Indicator: MACD should be used in combination with other indicators or analysis methods for better confirmation of signals.

- Whipsaws: In volatile markets, MACD crossovers can result in frequent whipsaw trades, leading to frustration and reduced profitability.

It’s important to be aware of the limitations of the MACD and use it as part of a comprehensive trading strategy. Combining MACD with other indicators and risk management techniques can help improve the overall trading performance. Traders should also consider backtesting and practicing with historical data to better understand the MACD’s behavior in different market conditions.